Are Student Loans Protected From Garnishment

Most student loans are unsecured loans. Student loan wage garnishment works like this.

Employer Wage Garnishment Guidelines Adp

The letter comes nearly a month before student loan and interest payments are set to resume on January 31 2022.

Are student loans protected from garnishment. For instance lets say you deposit a 5000 student loan in your bank account have a paycheck deposit on. Student loan servicers can choose to garnish a borrowers wages without taking them to court. Department of Education USDOE to suspend administrative wage garnishment of student loan borrowers.

In general there are all sorts of penalties that come with ignoring your federal student loan payments including garnishment. Department of Education to suspend administrative wage garnishment of student loan borrowers. Senator Cory Booker D-NJ led colleagues in urging the US.

Forgiven debt may be taxable Generally when a debt is settled or forgiven the forgiven amount is considered taxable income. Most people with federal student loans got some relief recently thanks to the Coronavirus Aid Relief and Economic Security Act. Your student loans Pell grants and others and work assistance are exempt or protected under Federal law regardless of which state you live in.

Again their ability to do those things depends on your states laws Typically private student loans dont sue you right after you have a late payment or default. State law wage garnishment protections do not apply but the federal limit on wage garnishment applies to these administrative student loan garnishments. They can also place a lien on your real estate but only if they sue you and get a judgment.

For most federal student loans the federal government has halted income garnishment and other collection actions such as offset of Social Security benefits and tax refunds. As of December 20 2018 the Higher Education Act authorizes the Department of Educations guaranty agencies to garnish up to 15 of disposable earnings to repay defaulted federal student loans. If a defaulted student loan is unsecured like all federal student loans and most private student loans the lender must sue the borrower and get a court judgment against the borrower before they can seize the borrowers property.

In aggregate the Student Borrower Protection Center says that as of June 2021 37 million in improper wage garnishments have not been refunded to student loan borrowers even though these. While garnishment threats can be intimidating and create fear student-loan debt collectors must comply with the Fair Debt Collection Practices Act the main federal law providing consumer protection rights to debtors known as the FDCPA. While some federal student loan forgiveness programs arent.

While both private lenders and the federal government can garnish wages on. Take Control Of Your Student Loans. Student-loan borrowers have had 37 million in wages unfairly garnished despite COVID-related pause on collections.

30 times the minimum wage. For someone who normally takes home 2000 each month. WASHINGTON KTVZ -- Sen.

Such withholding is also subject to the provisions of Title III of the CCPA but not state garnishment laws. Senator Ron Wyden this week joined colleagues in urging the US. Student Loan Sage is here to help you navigate the different federal programs and get you approved for lower monthly payments.

Department of Education USDOE to suspend administrative wage garnishment of student loan borrowers. Yes the federal wage garnishment has been halted. Since Congress transferred sole authority to originate federal student loans to the Department of Education in 2010 Guaranty Agencies have effectively been little.

Ron Wyden D-Ore this week joined colleagues in urging the US. Private student loans can garnish your wages and bank account. We can help you get loans out of default stop wage garnishment and help you keep more of your hard earned money.

However if you mix these monies with other monies they could lose their exempt status or be hard to trace. As part of the 2020 CARES Act student loan salary garnishment was prohibited. Treasury can garnish your Social Security benefits for unpaid debts such as back taxes child or spousal support or a federal student loan thats in default.

An automatic suspension on payments interest rates set to zero. Student loan wage garnishment is a legal practice. Garnishment can be up to 15 percent of total pay but a certain amount of pay is protected.

Currently over 9 million borrowers are in. We Can Help You. Thus a minimum of 30 times the federal minimum wage21750 a weekof disposable earnings is fully protected.

Student loan and interest payments are set to resume on January 31 2022. Default on your federal student loans and the government can take up to 15 of your paychecks. The letter comes nearly a month before student loan and interest payments are.

You could lose money owed to you through federal government payments such as your income tax refund and Social Security disability checks via a process known as Treasury offset.

54 000 People Had Their Paychecks Seized To Pay Student Loans Despite Pause

Student Loans And Wage Garnishments Under The Cares Act

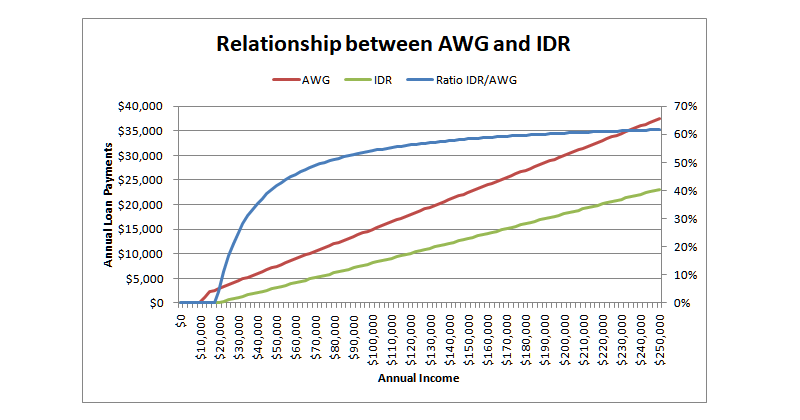

Student Loan Reforms Are Still Needed Louisiana Budget Project

Which Types Of Federal And State Benefits Are Creditors Not Allowed To Garnish Chicago Debt Collection Attorney

When Should I File A Declaration Of Exempt Income And Assets Washingtonlawhelp Org Helpful Information About The Law In Washington

It S Time For Washington To Stand Up For Millions Of Student Loan Borrowers Struggling Without Relief During Covid Student Borrower Protection Center

The Student Loan Pause Has Improved Credit Scores But Not Financial Distress Urban Institute

How To Stop A Wage Garnishment In Florida 2022

The Complexity Of Payroll Withholding For Student Loan Payments

Will Student Loans Take My 2020 Tax Refund Nerdwallet

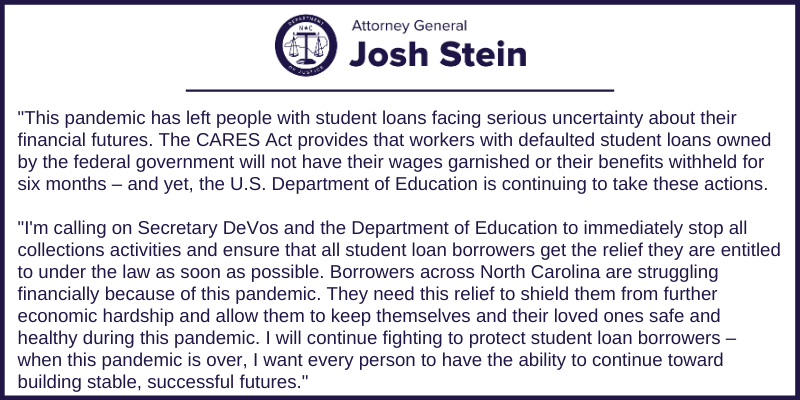

Attorney General Josh Stein Calls On Dept Of Education To Stop Garnishing Wages Of Student Loan Borrowers Nc Doj

Statute Of Limitations On Private Student Loans State Guide Credible

Bill Would Protect Social Security Against Student Loan Debt Benefitspro

These States Are Stopping Student Loan Debt Collection

Komentar

Posting Komentar